Mission 2026

Empower Regulated Industries with Fast and Accurate Proofreading

This document’s purpose is to establish long term goals that guide us to achieve our Mission so that we all swim in the same direction.

North star metric

The leading metric that matters most.

Winning aspirations

Our goals for when we cross the finish line on Dec 31, 2026…

DOUBLE our performance

$30M USD total revenue, with $27M USD in recurring revenue (ARR)

20 customers with $500k USD ARR

Operating efficiency of 30%

Be the BEST place to work

125 full-time GlobalVisionaries

Median Tenure of 3 years

eNPS of 80

Markets we will dominate

Brands

We are targeting Enterprise Pharmaceutical companies (> $1B revenue) in North America and Europe with Regulatory, Labelling, Promotional, and Incoming QA departments.

Suppliers

We are targeting Print and Packaging companies with Prepress and Production departments in global markets.

Secondary markets include Consumer Packaged Goods (CPG) and Agencies where we will have lower outbound efforts and roadmap prioritization but will still engage in opportunities.

How we will win in Brands in 2025

Product Strategy: Build Verify into a market-leading product

Focus on the regulatory pharma use case

Launch CheckAI for CPG

GTM Strategy: Grow through high-value accounts

Success first, monetization second

Upsell clients from GVW to Verify

How we will win in Suppliers in 2025

Product Strategy: Unify to the Verify platform

Use SGS as the north star customer to finalize Prepress use cases in Verify

Expand our value offering by launching a pure automation product

Freeze GVD versions to enable GTM efficiency

Experiment with a new product for inline inspections

GTM Strategy: Refine the customer journey toward operational excellence

Geographical expansion in Europe and Asia

Upsell Prepress customers to Verify or Automation

How we will get there…

First, we need to be a “product-led” organization, where all teams funnel to the product to ensure that we are building what customers need for the long term, since we are still far from solving the 🌟 north star of automated proofreading for our customers.

North star of automated proofreading

Perfect inspection results in seconds with no user input, for all formats.

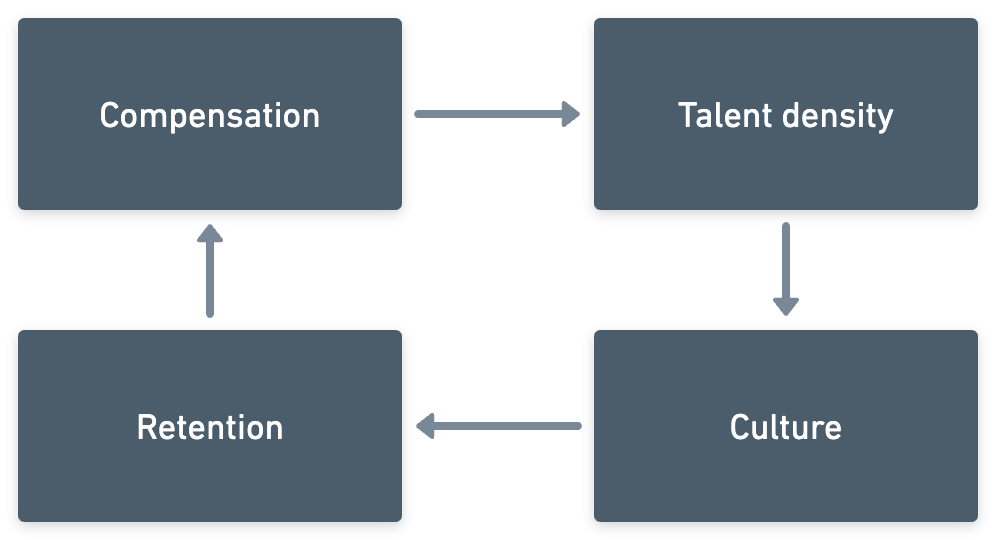

Second, creating a world-class culture as a remote-first company is the best way to ensure success in the rest of our strategy, since culture eats strategy for breakfast. Our pillars for winning are talent density and retention.

Scaling efficiency without scaling headcount

Constrain headcount to force innovation

Leverage bleeding-edge AI and technology to automate tasks

Outsource for scale

High tenure leads to high impact

Invest profits into current employees over more headcount

Higher compensation leads to better access to talent

High-performing coworkers leads to a more fulfilling employee experience

Better culture leads to higher retention

Higher retention leads to higher profits